There’s a lot to love about being a small business owner,contact us but we’d be lying if we said it didn’t come with its fair share of challenges, especially around tax season. From figuring out how to manage quarterly taxesto actually paying what you owe the IRS, the learning curve can be steep.

The process isn’t all bad, though. For example, there are certain tax breaks and deductions that are afforded to small business owners and self-employed individuals that regular employees don’t get to take advantage of.

If you don’t already know about the tax deductions that come with being a small business owner, you’ll want to read on. Here are twenty major tax deductions for small business owners that may surprise you:

Advertising fees

The costs associated with advertising your business are completely tax deductible. This can include things like getting business cards printed, launching a new website, social media campaigns, and even sponsoring a local event.

Bank fees

Bank fees such as PayPal transaction fees, wire transfer fees, and any service charges are 100 percent tax deductible. Keep in mind this only accounts for business banking accounts and doesn’t work for personal bank accounts or credit cards.

Business meals

Business meals are 50% deductible as long as they aren’t considered lavish or over-the-top. Keep in mind that meals for employees, like pizza Fridays, are considered 100% tax deductible.

Car fees

If you have a vehicle that you use entirely for business, all costs associated are tax deductible. If you use your car for personal and business use, you can still deduct certain costs, but only the costs associated with business use.

Charitable donations

You cannot deduct charitable donations as a business expense, but it’s possible to deduct these donations on your personal income tax return as long as they were made to a qualified charitable organization.

Childcare and dependent care

If you have children under the age of 13 or a dependent who is mentally or physically unable to care for themselves, you might be eligibleto deduct up to a certain amount of what you spend on childcare and dependent care while working.

Credit card interest

If you’ve opened up a credit card specifically for your business, any credit card interest is completely tax deductible. This also applies to other interest payments (such as a business loan) as long as you can prove that you intend to pay back the loan in full.

Depreciation fees

Depreciation feesare considered the cost associated with normal wear and tear on business-related machinery and tools. Depending on the cost of the items, you can deduct the entire cost of the item in one year or spread it out over several years.

Education

Things like tuition, books, subscriptions to trade-related publications, and workshops to increase your skill set and expertise are all tax deductible as long as they relate back to your immediate field and business.

Employee benefits

Being a good employer means treating your employees well — and you can actually deduct most employee benefits. Things like employee health benefits, achievement awards, and educational assistance are all tax deductions for small business owners.

Freelance labor

If you haven’t required full-time employees yet but still enlist the help of freelancers, the fees associated with freelance labor are also a tax-deductible cost.

Health savings account

Did you know that a health savings account is tax deductible for small business owners? You can use your health savings account up until retirement for things like doctor visits, gym memberships, and even massages.

Home office supplies

Home office supplies — from your laptop to your pens and pencils — are all considered tax deductible for small business owners and solopreneurs.

Internet and phone bills

Business-related internet and phone use is 100% tax deductible, but keep in mind that if you use your phone for both personal and business, only the dollar amount used specifically for business can be deducted.

Legal fees

Legal fees and services required for conducting your business are tax deductible. This also applies to accounting and bookkeeping services required to keep your small business running.

Rent

It doesn’t matter if you rent an office space or you run your small business from your apartment, rent is considered tax deductible. Keep in mind that you cannot deduct the entire amount of your apartment if you work from home but rather the percentage that you use for business.

Retirement contributions

You receive a dollar-for-dollar tax write-off for every single dollar you contribute to your retirement account (up to a total of $77,000). You can also set up an additional pension plan through your business which will allow you to contribute even more.

Tax preparation fees

Small business owners should always work with an accountant at tax season to ensure everything is properly filed. Thankfully any tax preparation fees and services are also tax deductible.

Travel expenses

If travel is part of your business requirements, you’ll want to save as many receipts as possible as there are many deductions available for business travel. As long as your trip is necessary for business, you can deduct everything from plane tickets and hotel fees to laundry and dry cleaning, tips, and parking fees.

Utility fees

Utility fees such as heat and hot water are also tax-deductible expenses. If your business operates out of your home, the entire fee isn’t deductible but rather the percentage you use while you’re actively working.

Topics Tax Season with Mashable

Apple is actively looking at AI search for Safari

Apple is actively looking at AI search for Safari

Tonight: Jenny Offill in Conversation with Lorin Stein by Dan Piepenbring

Tonight: Jenny Offill in Conversation with Lorin Stein by Dan Piepenbring

Elon Musk's X, formerly Twitter, reinstates Kanye West's account

Elon Musk's X, formerly Twitter, reinstates Kanye West's account

Apple confirms Screen Time bug in Parental Controls

Apple confirms Screen Time bug in Parental Controls

How to change the order of photos in a carousel on Instagram

How to change the order of photos in a carousel on Instagram

Tonight: Jenny Offill in Conversation with Lorin Stein by Dan Piepenbring

Tonight: Jenny Offill in Conversation with Lorin Stein by Dan Piepenbring

In Case You Missed It: A Look Back at Our February Essays

In Case You Missed It: A Look Back at Our February Essays

The Mismeasure of Media

The Mismeasure of Media

What We’re Loving: Science, Spicer, Sea Maidens, Sandwiches by The Paris Review

What We’re Loving: Science, Spicer, Sea Maidens, Sandwiches by The Paris Review

NYT Strands hints, answers for May 5

NYT Strands hints, answers for May 5

'Update and shut down' bug rocks some Windows users

'Update and shut down' bug rocks some Windows users

The Morning News Roundup for February 27, 2014

The Morning News Roundup for February 27, 2014

Wordle today: Here's the answer and hints for July 31

Wordle today: Here's the answer and hints for July 31

Best robot vacuum deal: Get the Roborock Q5 Max for 53% off at Amazon

Best robot vacuum deal: Get the Roborock Q5 Max for 53% off at Amazon

What We’re Loving: Don B., B. Dole, /u/backgrinder by The Paris Review

What We’re Loving: Don B., B. Dole, /u/backgrinder by The Paris Review

How to block a number on iPhone

How to block a number on iPhone

'Quordle' today: See each 'Quordle' answer and hints for August 1

'Quordle' today: See each 'Quordle' answer and hints for August 1

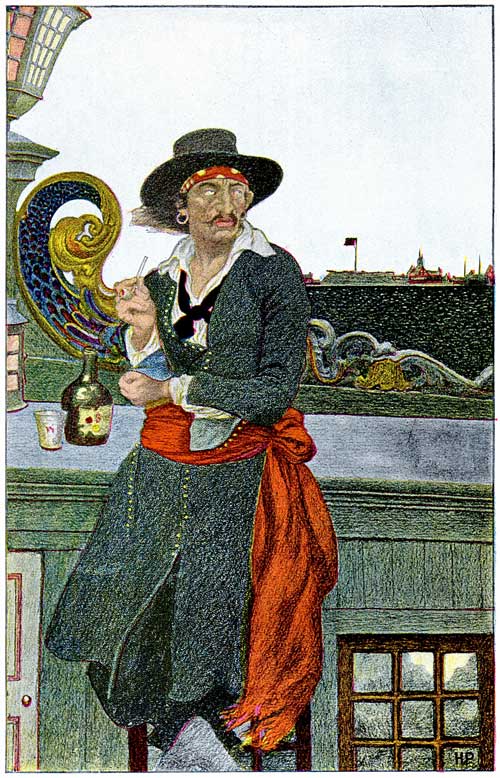

Happy Birthday, Howard Pyle! Look at these illustrations from his Book of Pirates.

Happy Birthday, Howard Pyle! Look at these illustrations from his Book of Pirates.

Twitter is shutting down its CoTweets feature immediatelyDon't freak out about the latest scary screen time studyWordle today: Here's the answer, hints for January 29Samsung Galaxy S23 vs S22: Specs, price, and more.'The Sims 4' update adds top surgery, binders, and hearing aidsLizzo doesn't mince words about people using body positivity for personal gainFederal Welcome Corps program lets private citizens sponsor refugee resettlement'Quordle' today: See each 'Quordle' answer and hints for January 28You have to watch this woman's very specific impressionsYouTube star Grandpa Kitchen, who cooked gigantic meals for orphans, has diedThis mom dressed her kids up as AirPods for Halloween, and yes, it's as adorable as it soundsTikTok's CEO is headed to Congress to testify about user privacy and safetyThe college major meme will roast you no matter what you studied15 gifts true fans of 'The Office' need in their livesSamsung Galaxy Unpacked livestream: How to watch the event live'Quordle' today: See each 'Quordle' answer and hints for January 28Peacock's free tier is now unavailable for new customersHeidi Klum's elaborate, 13Kim Kardashian shared a family Halloween photo with a hilariously bad PhotoshopSamsung Galaxy S23 vs. iPhone 14: Comparing specs and prices Air pollution is increasing in parts of the U.S. because of wildfires The best 'Fallout' games to play after watching Prime Video's TV series BYD hires former Baidu, Horizon Robotics engineer to make EVs more intelligent · TechNode Learn about the O.J. Simpson trial from CNN's ancient '90s website Judge tosses out another climate suit in NYC. What comes next? iFlytek introduces next Chinese AI startup Baichuan rolls out third LLM in four months · TechNode Lyrid meteor shower in 2024: How to see it despite the bright moon Shark FlexStyle deal: Save $85 during the Sephora Savings Event A landmark climate ruling could go up in smoke after Kennedy retires How to clean your sex toys Best Earth Day deal: Score the Google Nest Learning Smart Thermostat for under $200 Geely set to begin export of Zeekr EVs in mid Bertelsmann Investments commits $700 million to Chinese start Leinster vs. Glasgow Warriors 2025 livestream: Watch United Rugby Championship semi final for free Why Iceland gets away with killing massive, endangered whales iPhone users in 92 countries received a spyware attack alert Antfin sells 10.3% of $628 million Paytm stake to company’s CEO · TechNode Best tax software deals 2024: Turbotax and H&R Block reign supreme SpaceX rocket makes a beautiful pre

1.9293s , 10131.4140625 kb

Copyright © 2025 Powered by 【contact us】,Exquisite Information Network